TRADERS! TRADERS! TRADERS!

ARE YOU TIRED OF

OVER PAYING IN TAXES

LEARN TAX PLANNING STRATEGIES DESIGNED STRATEGICALLY FOR TRADERS

HERE'S HOW! PRESS PLAY >

I'm not maximizing trading deductions

I don't know which retirement account is best for traders

I'm trading under my social security # instead of EIN

I'm not keeping good records of my income and expenses

I don't know the difference between tax planning and tax paying

WANT TO SAVE MORE $$$$

BUT THIS SOUND LIKE YOU?

IN THE CHALLENGE, YOU'LL BE:

Rejuvenated with tax-saving ideas & strategies!

Equipped with non-complicated strategies that you can use right away to lower your tax bill!

Confident to pay the LEAST AMOUNT in taxes as legally possible!

💬 "Loved the webinar. Beautiful slides, super informative and laid back and just felt like good conversation."

💬 "Thank you! Your presentation was very informative and gave me some direction on how to get started with building a business to trade vice using my SSN."

💬 "thank you soooo much for answering my challenges about a tax business in the session" 🙌🏾

I'm really passionate about teaching traders how to save more money & keep more of their profits from Uncle Sam!

HERE'S WHAT YOU WILL LEARN IN JUST 3 DAYS LIVE WITH A TAX STRATEGIST!

How to maximize deductions

Tax Deductions

VS

Tax Credits

How traders are being taxed

Wealth management advantages

How to understand estimated tax

The best retirements accounts for traders

Tax planning VS Tax paying

Options for self-employed traders

Choosing The Best Entity for your Business

Which Trader Are You?

YOU NEEDS TO BE HERE

THIS CHALLENGE IS FOR

TRADERS WHO ARE:

👉🏾 OVERPAYING TAXES WITH THEIR PROFITS EVERY TAX YEAR!

👉🏾 MISSING OUT ON TAX BENEFITS TRADING AS AN INDIVIDUAL INSTEAD OF A BUSINESS ENTITY!

👉🏾 READY TO KNOW HOW TO BUILD WEALTH WHILE STAYING IN COMPLIANCE WITH THE IRS!

This 3-Day event provides over 8 hours of action-packed content that will have you on your way to implementing tax strategies you can utilize immediately to ensure your next tax bill will be less than your previous.

WHAT YOU'LL LEARN IN THE

TRADER TAX CHALLENGE

Day 1

Tax Fundamentals

On Day 1, we will be going through the fundamental things you need to set up in your trading business to not only ensure massive tax savings but also grow your business and avoid an IRS audit.

Day 2

Tax

Strategies

On Day 2 we will be taking it a step further. Now that we have the fundamentals in place, giving you a strong foundation, we will expand on what you have learned to bring in even more massive tax-saving strategies.

Day 3

VIP DAY

LIVE Q&A

On Day 3, we will have a LIVE Q&A session with Abby the Trader Tax Strategist to ensure you are fully equipped to make 2022 the year you start paying the least amount in taxes as legally possible.

THE TRADER TAX CHALLENGE WAS CREATED JUST FOR YOU.

You’re just a few steps away from saving money on your taxes and putting more money in your pocket!

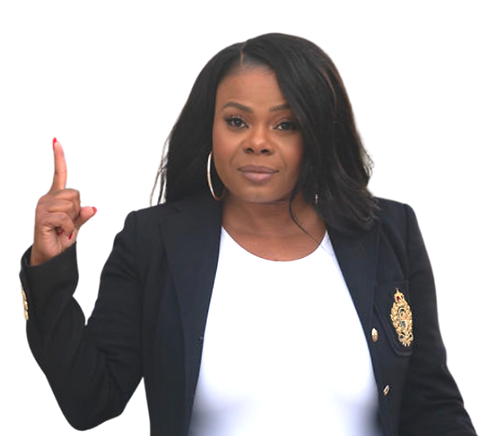

MEET YOUR INSTRUCTOR

Abby Joseph | Your Tax Strategist

As a trader and investor myself, I know what it's like to make profits and have to pay taxes every single year. But as a tax strategist I've been able to save thousands and help traders save on their taxes as well.

Raised around entrepreneurs my entire life and now, a CEO myself, I knew there was a better way to own and manage your dream company. So, I created Serenity Financial desiring to show business owners and retail traders what true freedom could look like.

We want our traders to focus on investing and builoding generational wealth while we handle the back end — fulfilling all of their accounting needs.

I'm also here to educate traders on how to successfully manage their trading business the RIGHT WAY - maximizing tax savings and minimizing tax liabilities.